Introduction

Financial security has become a basic need in today’s times. Every person wants his family and property to be safe, no matter what uncertainty comes in life. Insurance is an important tool for this safety and security. The most common question people ask is about the Difference between Life Insurance and General Insurance. These are the two most common categories of insurance – Life Insurance and non-life or General Insurance.

But often people are confused about the Difference between Life Insurance and General Insurance, why both are important, and which one is right for you. In this blog, I will explain the Difference between Life Insurance and General Insurance in simple language, with practical examples for better understanding.

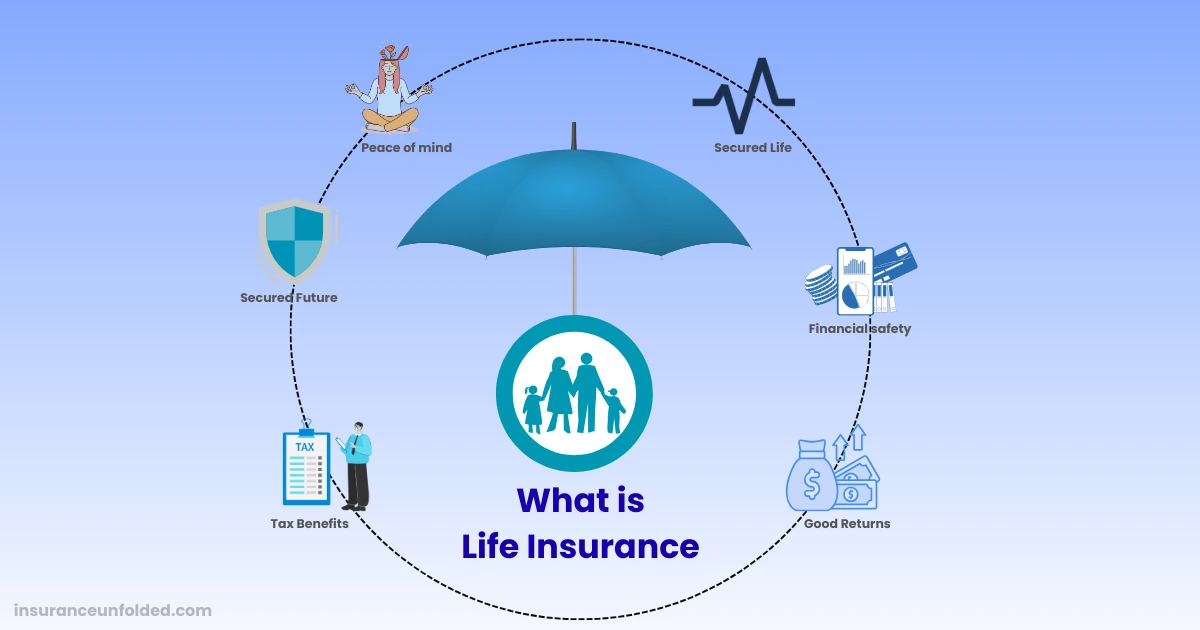

Life Insurance – A Protection Cover for Life

Insurance is a contract and life insurance is a long-term contract in which a person buys financial protection against his life. If the insured person dies during the term of the policy, his family or nominee gets a fixed amount (sum assured). This contract is a kind of financial backup plan that ensures that if the earning member is not around, family expenses, children’s education and household needs are met.

Understanding the Difference between Life Insurance and General Insurance is important here, because life insurance focuses on securing the future of your dependents, while general insurance protects your assets, health, and day-to-day risks.

This contract is a kind of financial backup plan that ensures that if the earning member is not around, family expenses, children’s education and household needs are met.

The salient features of life insurance are as follows

- The policy period is generally 10–30 years.

- This is also an option for investment and savings.

- Tax benefits are available (u/s 80C and 10(10D) of IT Act).

- There are two types of benefits:

Death Benefit – if the insured dies.

Maturity Benefit – if the insured remains alive till the end of the policy.

For example, a person ‘X’ is a 25-year-old youth who buys a 30-year term life insurance plan for his family with a sum assured of ₹1 crore. If he dies within the policy term, his family will get ₹1 crore. If he survives, in some policies a lump sum return is also available at the time of maturity.

This simple case clearly shows how life insurance works, and when we compare it with general insurance, we understand the real Difference between Life Insurance and General Insurance.

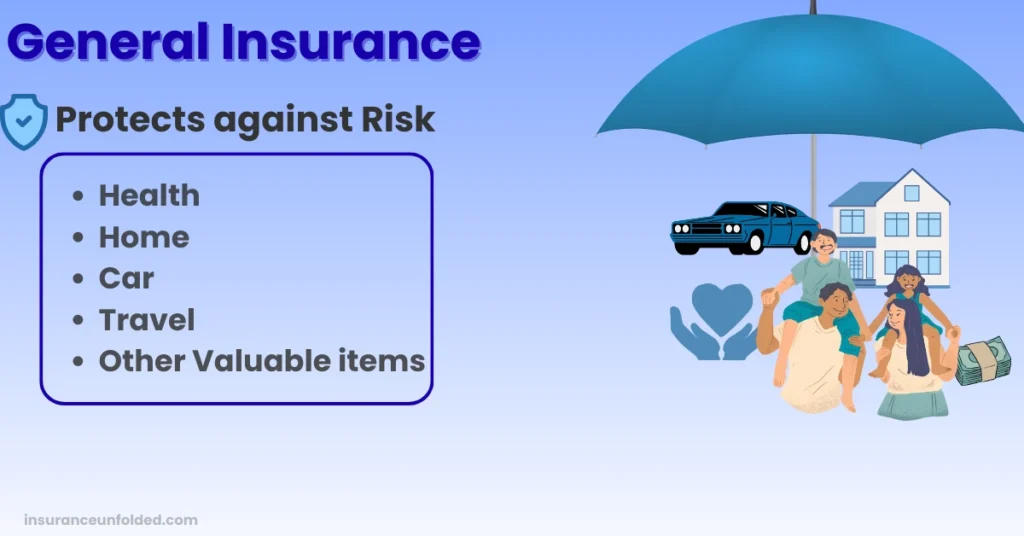

General Insurance – Protection for everything other than life

As the name suggests, General Insurance covers all kinds of risks other than life. This category includes health, motor, home, travel, fire, marine and business insurance. This contract usually has short-term policies (1 year) which have to be renewed on a yearly basis. General Insurance provides benefits only at the time of any loss or damage. There is no option of savings or maturity in this.

To clearly understand the Difference between Life Insurance and General Insurance, note that unlike life insurance, general insurance does not provide long-term financial protection or savings—it only covers specific risks during the policy period.

The salient features of General insurance are as follows

- Provides short-term protection (generally 1 year).

- Claim is made only when the risk occurs.

- It does not have maturity benefit.

- Examples: Health Insurance, Car Insurance, Travel Insurance, Fire Insurance.

Example: A person ‘Y’ takes a health insurance policy in which a sum of ₹ 5 lakh is insured. If he needs hospitalization, the insurance company will pay his medical bills. If there is no need for hospitalization in a year, he will not get any refund.

Life Insurance vs General Insurance – Side by Side Comparison

| Factor | Life Insurance | General Insurance |

|---|---|---|

| Objective | financial security of the family (death/maturity) | Protection of assets and risks (health, car, etc.) |

| Policy Duration | Long-term (10–30 years) | Short-term (1 year, renewable) |

| Benefit | Benefit in both death and maturity | only when there is risk |

| Maturity Benefit | Available (some policies) | Not available |

| Premium | Relatively higher and fixed | Comparatively lower and flexible |

| Tax Benefits | 80C + 10(10D) | 80D on health insurance |

| Examples | LIC Jeevan Anand, HDFC Life, SBI Life | ICICI Lombard Health, Bajaj Allianz Car, New India Assurance Fire Insurance |

With the help of the above table you can easily understand the difference between Life Insurance and General Insurance.

Which of the two should you take?

As we have now understood the Difference between Life Insurance and General Insurance, the next question is whether it is necessary to take both insurances or if choosing only one is enough. The truth is that life insurance and general insurance are not alternatives to each other. If you want long-term financial security for your family, you should get life insurance.

On the other hand, if you want to protect your assets, health, travel or home, then general insurance is a must. Understanding the Difference between Life Insurance and General Insurance helps you realize why having both together makes your financial planning stronger.

For example Mr. X is a salaried employee. He took a term life insurance for his family so that if something happens, the family remains financially secure. Along with this, he also took general insurance for his health and car so that daily risks are covered.

Why You Need Both ?

- Comprehensive Protection: If you take only life insurance, then risks to your health, property and valuable assets are not covered. Taking only general insurance does not provide long-term security to the family.

- Peace of Mind: You have the confidence that you have a financial backup ready for every situation

- Balanced Financial Planning: Life insurance helps with savings and investments, while general insurance handles unexpected expenses..

Conclusion

Insurance is a necessity, not a luxury. Life Insurance secures your family’s future, while General Insurance protects your assets and health. If you truly want to make your and your family’s financial planning solid, then taking a combination of both insurance plans is the best strategy.

By understanding the difference between Life Insurance and General Insurance, you can make smarter financial decisions and choose the right policies for your needs.

Choose the right plan according to your needs today and make your future secure.

Pingback: Step-by-step Guide to Easily Calculate Insurance Coverage - Insurance Unfolded